SAP FSCM - Credit Management

SAP Credit Management centralizes credit policies and customer credit monitoring in one system. It automates credit limit calculations, integrates with external credit agencies, and offers web-based access for sales teams. The system also supports customizable scoring, distributes customer data, and provides strategic reports to accelerate credit decisions, enhancing productivity by focusing on exceptions.

SAP Credit Management

System to implement a companywide credit policy, even in a distributed system landscape

Monitor a customer’s credit exposure in one central system

Customer scoring using own scoring rules creating new reports and queries

Interface to external credit agencies

Automatically calculate and assign a customer-specific credit limit

Web-based access to credit information for salespeople

Distribute customer master data via Master Data Management

Strategic credit analysis with predefined reports – centralizes all information to speed credit decisions

Improves productivity by automating credit decision process and focusing on processing exceptions

Credit Management options in SAP S/4HANA

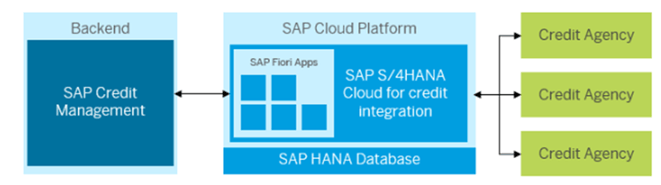

SAP Cloud for Credit Integration

The SAP S/4HANA Cloud for Credit Integration is designed to function as a central information hub that seamlessly links your SAP Credit Management system with external credit agencies. This integration provides you with enhanced and potentially more straightforward access to external credit risk information, which is essential for making well-informed credit decisions. By integrating external credit data into your existing system, it allows for a comprehensive view of your credit exposure and risk.

Moreover, SAP Cloud for Credit Integration plays a pivotal role in automating the continuous monitoring of your customers’ credit risk profiles. This automation not only streamlines the credit management process but also ensures that your assessments and decisions are based on the most current and accurate information available. As a result, you can better manage credit risk, improve decision-making, and maintain more robust credit controls, ultimately contributing to a more efficient and effective credit management strategy.

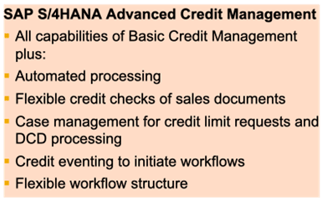

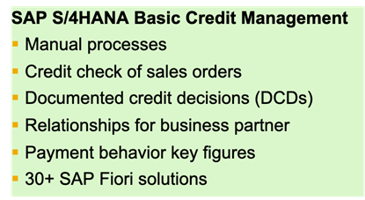

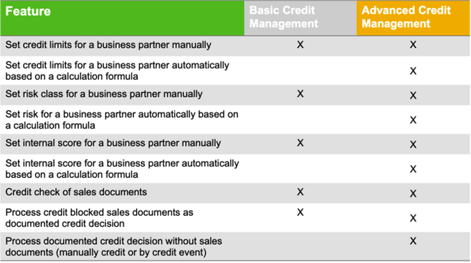

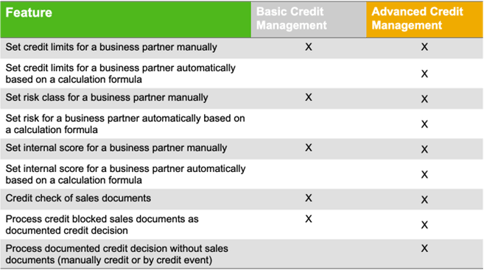

Basic vs. Advanced Credit Management

Basic credit management primarily focuses on fundamental risk assessment and control measures. It involves standard tools for evaluating creditworthiness, such as setting credit limits and payment terms. Typically, this approach relies on manual processes and basic credit checks based on historical data and simple financial ratios. Automation is limited, often requiring significant manual input and providing only basic reporting capabilities. As a result, basic credit management can be less flexible and slower to adapt to changing credit conditions and customer profiles.

In contrast, advanced credit management adopts a more comprehensive and dynamic approach. It leverages sophisticated tools and techniques, including real-time credit scoring, predictive analytics, and dynamic credit limits. This method employs advanced algorithms and integrates external data sources to assess credit risk with greater accuracy and foresight. Automation is more prevalent, with integrated systems offering real-time insights, automated alerts, and the ability to adjust credit terms dynamically. Consequently, advanced credit management is highly adaptable, enabling quicker responses to shifts in credit conditions and customer behavior, and enhancing overall efficiency and effectiveness in managing credit risk.

4. Credit Checks

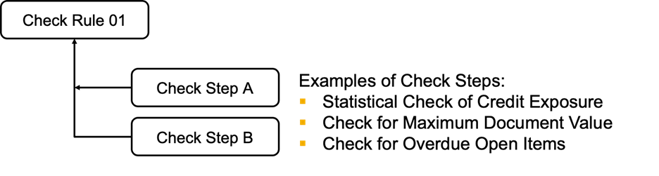

Credit checks are linked to a credit check rule, which is then assigned to particular business partners.

Check rules are established with one or more check steps, allowing for the definition of specific criteria or actions.

Additionally, there are options to create tailored solutions by implementing custom check steps using the BADI UKM_CHECK_STEP.

Credit Management Overview

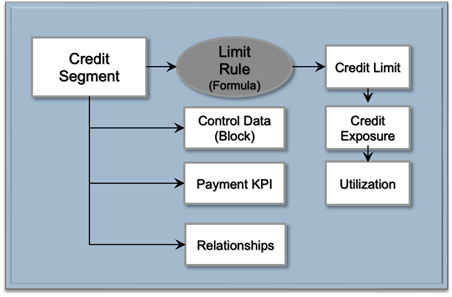

Credit Limit Management

Implement a companywide credit policy

Manage a customer credit profile

Central credit management in a distributed system landscape

Credit Case

Credit case for structured processing of credit limit applications

Track status and result of credit limit applications

Credit Rules Engine

Categorize customers by scoring rules

Automatically calculate and assign a customer-specific credit limit

Credit check rules

Model and implement own customer credit score cards

Credit Information

Interface to external credit agencies

Input parameters for scoring rules

Credit Manager Analytics

Role-based access to credit management information and analysis

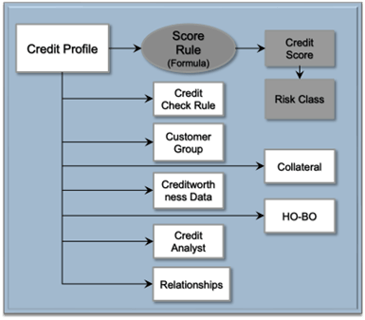

Credit Profile and Credit Segment in SAP Business Partner

Credit master data is defined per credit management Business Partner with role UKM000. Settings are maintained in transaction UKM_BP (preselected for role UKM000) on 'General Data' -> 'Credit Profile' tab and on 'Credit Segment data' tab.

Credit checks are associated with specific credit check rules, which are assigned to designated business partners.

Check rules consist of one or more check steps that define specific criteria or actions.

You can also create customized solutions by adding bespoke check steps using the BADI UKM_CHECK_STEP.